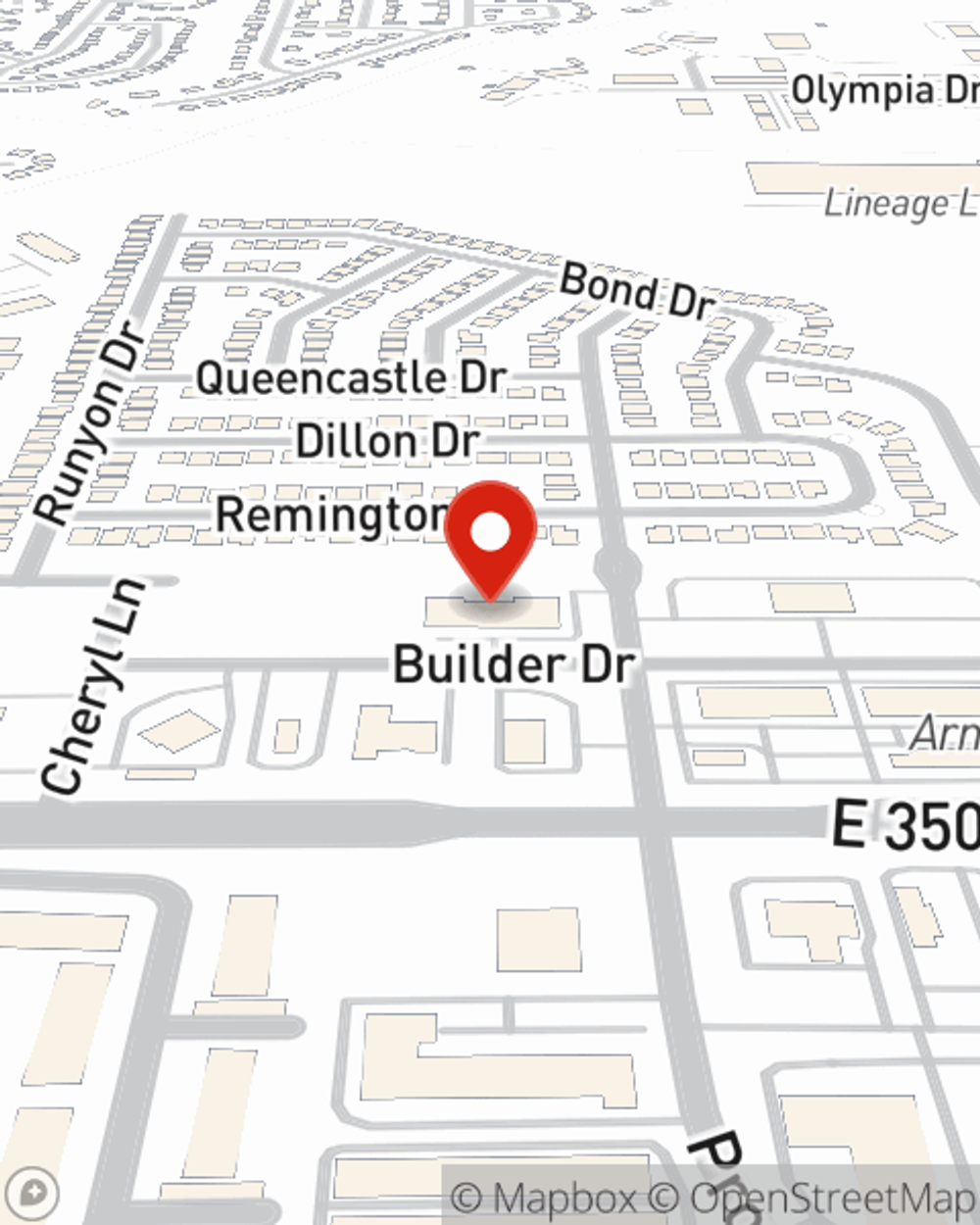

Condo Insurance in and around Lafayette

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

Your condo is your home base. When you want to chill out, kick back and catch your breath, that's where you want to be with family and friends.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

That’s why you need State Farm Condo Unitowners Insurance. Agent Austin Kyle can roll out the welcome mat to help create a policy for your particular situation. You’ll feel right at home with Agent Austin Kyle, with a no-nonsense experience to get high-quality coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Austin Kyle can help you file your claim whenever bad things happen. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let concerns about your condo keep you up at night! Call or email State Farm Agent Austin Kyle today and learn more about how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Austin at (765) 701-6376 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Austin Kyle

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.